Effective marketing in the crypto era

How blockchain companies fuel explosive growth through precise incentives and user ownership

“This isn’t natural growth, it must be fraud!” one person exclaims while debating the exploding crypto projects over the past few years. And indeed, there is a long list of projects that have been surging to unbelievable size. Is there any way this can be justified?

When looking beyond those who dropped back to insignificance just as fast, one finds that the remaining ones reached size for all the right reasons: (1) A flawless product created by (2) a good team and (3) distributed with the best possible tools to those who desire it the most.

We will focus on the last part and discover that in the crypto field, conventional methods are being replaced by techniques that come with major advantages, not only for organizations but also target users. And in doing so, it will have a lasting impact on how marketing is done.

What is good growth?

You might have already asked yourself how the massive growth rates of crypto projects are even possible. Paul Graham from Y Combinator famously put a number on what growth rates should be at a startup: "A good growth rate during YC is 5-7% a week. If you can hit 10% a week you're doing exceptionally well."

That's an anchor for the metric a company will choose, such as revenue, users, units, visits, clicks, or API requests. Even though 5-10% per week is already a lot when compared to conventional businesses, crypto companies have regularly hit growth rates well beyond that and reached staggering size within short timespans. And while the product itself may still remain the driving force behind any lasting success, we will examine what distribution tools are supercharging these developments.

Before we go deeper into the rabbit hole, we first need to set a baseline for the current state of online marketing.

How conventional online marketing works

“Half the money I spend on advertising is wasted; the trouble is I don't know which half.” John Wanamaker (1838-1922)

Meet Adrian, a crafty online marketer. On a good day, he's pouring a few thousand dollars into Instagram ads. He can set a few parameters but has no idea who ends up seeing his craft until a new user reveals herself in the form of a signup. Everyone else, only Mark and his pals knows about.

The channel is considered profitable as long as the money spent per acquired customer is below its lifetime value. Adrian knows that the marginal cost for acquiring the next user through the same platform steadily increases, eventually rendering it unprofitable. Hence, he is flipping through new combinations of text, media, and landing pages while carefully watching his metrics turn against him.

Ad platforms taking a huge cut of the product sale, nebulous algorithms making decisions on whom to present something, or paying in advance for a mere chance to make the sale – all these are widely accepted norms nowadays. It’s how it’s always been and despite all the critisizm, this method of monetizing people’s attention was lightyears ahead of what was possible with newspapers, fax ads, callcenters, TV, or billboards.

While we are still at the beginning of the crypto era, the next marketing revolution is well underway.

Crypto marketing 101

Every company's dream is word-of-mouth distribution (WOM) or at least some sustainable source of users that doesn’t dry out the moment the budget is reduced. The main problem with that is that WOM is relatively hard to get based on a first version. Also, it is somewhat slow. And before you start typing that ferocious Tweet to correct me: Yes, there are counter examples but broadly speaking, the majority of companies would like to grow at a faster than their current rate – otherwise they wouldn’t be spending huge amounts on marketing campaigns left and right to “help spread the word”.

The interesting thing about crypto projects is that most of them come with three highly effective, built-in financial and non-financial incentives. And a third one that sits somewhat in the middle: Ownership.

Financial rewards

Imagine you could design a system that predictably sends a certain number of users through your product funnel, from start to finish. This is how growth is usually thought of in the conventional startup world but the crypto world has a few special twists. Before we go into the mechanics, we need some vocabulary (that you may abstract away from the user):

Token: In the crypto world, a token is usually something of worth (e.g. Ether).

Wallet: An electronic safe for tokens. It has a unique address that usually starts with something like "0x504..." and frequently acts as the sole login for blockchain applications.

Airdrop: The act of sending "free" tokens to wallets.

Blockchain applications are typically able to map a user with their address without knowing anything else about them. This allows the app developers to precisely track what someone has done and distribute rewards if they so decide.

The airdrop has become one of the dominant financial incentives for early users to join a platform and it also explains why “crypto people” tend to be hectic when they discover new projects. In the early days, these airdrops were given to users who merely showed up. Smarter projects distribute rewards after certain key actions have been performed or liquidity has been provided to the system – whatever the team believes to be sufficient at the given stage of the project.

As you are reading this, you might think that incentive design itself is everything but strange to product makers and marketers. The main difference is that, in the crypto world, value transfers are often a key component of the job-to-be-done. On top of that, rewards one one platform are portable to another, which is generally not true for platform-specific rewards like InMail credits on LinkedIn.

Of course, you will get a slight bias in your user base in the form of people trying to make a quick buck. But as I laid out above, the days of money-for-nothing are counted and the chances that someone with a genuine interest ends up becoming a regular user manifest themselves in high retention rates of many crypto companies. The airdrop and other financial incentives helps users do the right thing earlier.

In addition to airdrops for certain actions, there are also early bird schemes in place. This is something you can also do in a normal setting but with transparency comes that extra bit of trust that the “Only 99 tickets remaining!!!” is more than some marketer’s banter.

Non-financial rewards

The second method can ultimately lead to financial rewards but it tickles users in a different way. Non-financial rewards are designed such that users experience joy through collecting and/or creating "their own" version of something.

Let's take a look at an example: Zapper is a dashboard that lets users display their wallet data and do a few other convenient things. Beyond the core functionality, users can claim rewards for a variety of things like building a daily habit (blue) and performing key actions (green).

... which can be turned into a reward on the same platform ⏬

Whether you personally care about such items or not should not affect your view on the technique itself. It is highly effective for two reasons: Value flows only to those who care and the team can adjust parameters over multiple rounds of iteration.

Can this also be done with conventional software? Of course! If you have ever used habit-building products such as Duolingo, fitness apps or Khan Academy, you will know their streaks and badges for achieving certain milestones. But the problem with these is that rewards are generally locked in a particular ecosystem; I would love to give another running app a spin but I'm on the purple level on Nike Run Club and I'm kind of determined to get the Volt level in about nine years. Swoosh, locked-in for life!

The power from these non-financial rewards is that they can often be turned into financial compensation if the holder so decides – provided that the issuer allows it: My wallet, my choice. And I would consider selling that piece of information to my health insurance if I got something in return (or at least give them a kind heads-up about a potential knee surgery at age 48).

Now, the alert reader might think “Busted! Lock-in is good for companies!” From a company standpoint, this is somewhat true – we will come back to that. But as a user, wouldn’t you rather engage with a platform that lets you pack your things and leave for something better overnight? Freedom to switch helps to keep the company’s interests aligned and selects for better companies in the long-term. A monopoly on my running stats gradually turns the app into a billboard.

Ownership

To some degree, ownership is an underlying theme for the above. However, this third growth mechanism is the one that I only understood through the recent surge in the number and size of DAOs (decentralized autonomous organizations) which are somewhat different from your normal token or NFT investments. In case you haven’t been dragged down the Crypto Twitter alley on this, here is a TL;DR:

In the blockchain-world, a DAO is a community-driven, self-governing body that is held together by a set of smart contracts that ensure that decisions are implemented as commonly agreed upon. These DAOs typically pursue one or several objectives that a large group of its members want to promote. Voting on proposals is commonly done in a capitalistic fashion through their own tokens.

Put more simply, a DAO lets its members acquire a stake in the form of tokens, make proposals, and vote on them – ownership in the purest form. As can be seen in financial markets, there is a premium on influence over entities (voting shares tend to be more expensive than non-voting shares) and I dare to say that the same is true in crypto. If you are familiar with loss aversion, you will know that people have a tendency to get emotionally attached to something they own.

While some people view it purely as a financial investment, this increased level of involvement goes beyond pure ICO-type coin investments where voting may be a part of the agreement. In the case of DAOs, it sits at the very core and we are in the middle of finding out how these projects are going to evolve over the next few years.

As these owners become financially and emotionally attached, each of them turns into a potential multiplier. Because even if they may not consider themselves one, the aggregate of people having conversations with others will grab the attention of someone who might spread the word a lot to those who assign the highest value (dare you say excessive valuation!) to the offering.

Large parts of society have recognized that their investment of time is the only thing that makes a service valuable in the first place. As such, it comes to no surprise that they command their fair share.

It is important to note that not every offering lends itself to be governed in such a manner. But for those that benefit from being a public good, the chances are that literal buy-in of the right people can drive growth and sustained adaptation beyond imagination.

Who benefits, when and for what?

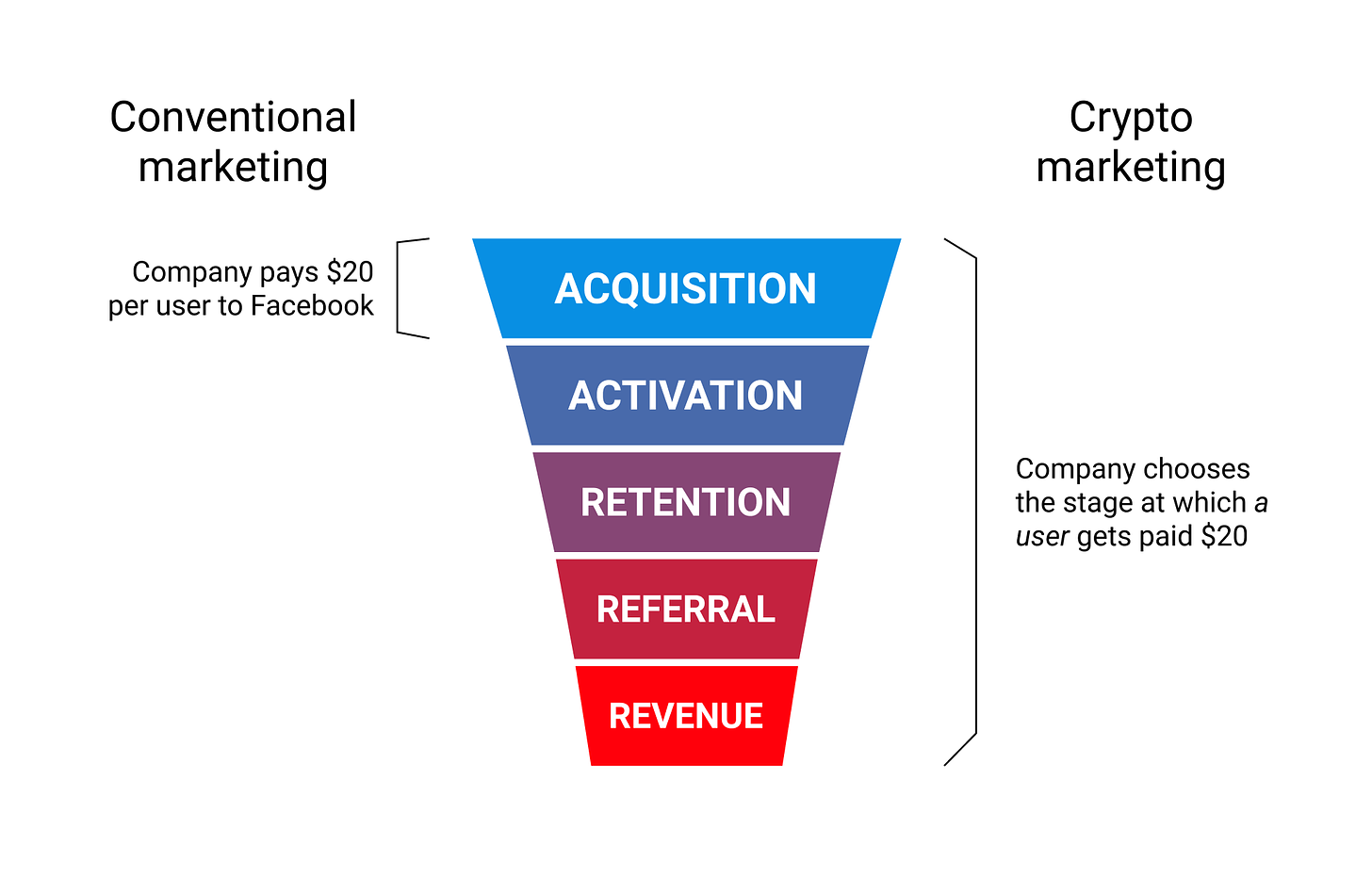

With the nature of incentives in the books, it seems worthwhile examining the differences in payment schemes.

In the conventional system, giving users an incentive to do things is additional cost for the company after having paid for the acquisition already. In the crypto system, it’s the only cost. It lets users – rather than ad platforms – obtain the majority of marketing spend.

Although ad platforms are improving their statistical models consistently, the conventional system consumes the vast majority of funds for people who will never convert into the controlled part of your funnel, thus driving up the average cost for acquiring someone who is at least considering to take the next step.

Apart from the user getting paid rather than an ad platform, the company can even decide and communicate what actions are to be performed: You want your users to send a Tweet (= referral) from an account with at least 500 followers? No problem. Or do you want them to trade an asset and spend fees on their platform? You got it. And do you dream of shadowing a few hundred user sessions over the next month? Clear your schedule!

Sceptics may now attempt to disarm the argument by exclaiming that all this can be done with a combination of trial discounts, referral kickbacks and an internal point scheme for a gamified experience. While part of this is true, the ownership element and the liberty to let go of the same at the owner’s will is what makes all the difference. You simply can’t trade Lingots for anything outside of the Duolingo system.

True loyalty and sustainable growth

Are trained habits and rewards-driven user behavior the same as loyalty? Of course not and every company that (partly) relies on these for their services are experiencing issues with retention. But nonetheless, these are helpful to get things off the ground and understand which users come and what they stay for.

Incentives are merely a means to an end that ultimately needs to come from within the user. The user has to really want to stay and talk about your gadget. But all the above feeds into a structural shift that cannot be underestimated: A well-designed user incentive journey can help solve the cold start problem for network businesses.

Cold start problems are a challenge for every network businesses, where the first users get little to no benefit from being early. And as Matt and Fred from Paradigm point out, this has largely caused a static Top 10 in app stores over the past decade. Addressing the the cold start problem effectively reduces the barriers for new businesses to entry, thus increases competition, and finally benefits the end user.

To use the Zapper example again: I have switched to a different system that better fit my needs, even though I was a big fan of their pleasant user experience. Their challenges are to make the improvements I would like to see and somehow win me back when done. To me, that’s a fair deal.

In terms of long-term sustainability of such techniques, the secret ultimately lies in the best possible experience for those using the product on the regular already. But one aspect of that might be the continuous sharing of rewards with users, and let them enjoy the ownership benefits as a response to what they already are: A loyal user of your product.

When adding true participation through ownership to the mix, you might eventually arrive at a stable state that is neither extractive nor unprofitable on either side: Users understand that certain things come at a price and are much more likely to pay a price if they have a true stake in proportion to their involvement. All they want is someone to take good care of it.

How to use crypto marketing for conventional products

The above must be regarded as a light appetizer for what is becoming possible with crypto-native incentive mechanisms. But it should be enough to take the story around the question you might have already asked yourself while reading the above: “How do I benefit from all this?” The short summary: Crypto marketing can work for non-crypto products.

You might have noticed that large brands have jumped on the NFT train recently. My current favorite:

You might think that all of it is just pure publicity or brand building. In some cases, that is probably true. You might even argue that some major brands are just trying to get on the bus but not knowing where it’s headed. But the smart companies don't let people claim their tokens on random websites and by simply connecting their wallets. They will turn this claim into a journey that leads users past other offerings and stimulates desired behavior.

What the future holds

It is easy to be cynical about the crypto world, for it is littered with utter nonsense, cash grabs and things most societies don’t want in their systems. But this bloated and disproportionately noisy long tail conceals the possibilities that can be exploited in the most productive manner. All it requires is imagination and good execution.

This new form of marketing will have a major impact on marketers, builders, and users alike: As a marketer and builder, the main difference between conventional marketing and crypto-style marketing is that money only gets spent when a desired action has been completed instead of blindly pouring thousands into Facebook et al. And as a user? Well, users can finally earn the fruits of their labor right from the start and can be more confident that the platform will remain on their toes to keep their users happy in the long-term.

Just like brands still advertise in newspapers in the online age, the audience- and click-based marketing tools aren’t going to simply disappear because maximum reach is a thing. But without a doubt we will see a major shift over the next few years where brands discover how effective customer journeys can be designed using the mechanisms I described.

I admit that meme coins and NFT art changing hands for millions aren’t helping everyone to build confidence in unknown technology. However, those who dig deeper should soon discover ideas and projects that have a lasting impact on how an increasingly digital world is being stitched together. Decentralized finance, digital property rights of real objects, enhanced voting and high-speed governance, proof of membership, open world gaming, and everything metaverse – for all this and more, blockchain technology will become the invisible layer underneath that makes new things possible in the first place.

With that in mind, adding crypto tools to conventional products hopefully feels less like a fraud but rather as a viable extension. It certainly proved worthy for a number of projects that are now in prime position to build the future of all the above and it will continue to get refined as these new strategies are becoming the norm.

Much like the Internet in the late 90s, crypto and blockchain are entirely opt-in. But any business who embraces these new paradigms today will be able to reap outsized rewards for years to come and be in a prime position once it becomes inevitable.

Thank you Tim Wagner for providing feedback on early drafts of this.